Understanding the Importance of Accurate Record Keeping for Self-Employed Individuals

Related Articles: Understanding the Importance of Accurate Record Keeping for Self-Employed Individuals

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to Understanding the Importance of Accurate Record Keeping for Self-Employed Individuals. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Understanding the Importance of Accurate Record Keeping for Self-Employed Individuals

The journey of self-employment is often characterized by a sense of freedom and autonomy. However, this independence also comes with significant responsibilities, particularly when it comes to financial management. Maintaining accurate records is paramount for self-employed individuals, as it serves as the foundation for successful tax filing, financial planning, and business growth.

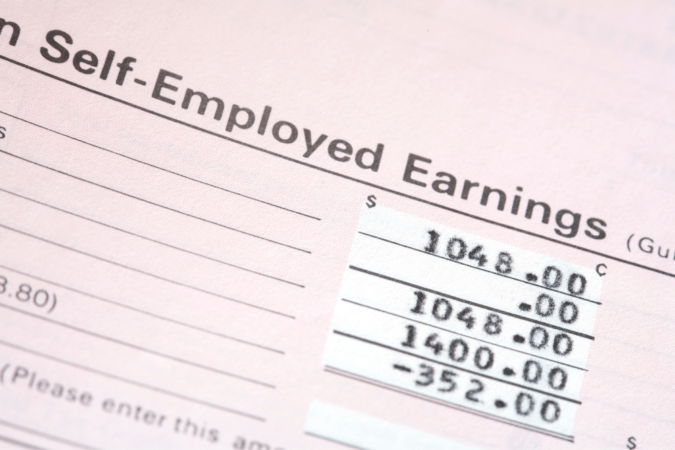

While the specific requirements for record keeping may vary depending on the individual’s business structure and location, one key document that often plays a crucial role is the self-employment work calendar. This document, commonly known as Form 126, provides a comprehensive overview of the self-employed individual’s work activities, allowing for accurate tracking of income, expenses, and time spent on various tasks.

The Significance of Accurate Record Keeping

The benefits of meticulous record keeping for self-employed individuals are multifaceted and extend beyond fulfilling tax obligations.

- Tax Compliance: Accurate records ensure that self-employed individuals can accurately calculate their taxable income and expenses, minimizing the risk of penalties or audits.

- Financial Planning: Detailed records provide valuable insights into income trends, expenses, and profitability. This data is crucial for informed financial planning, including budgeting, investment decisions, and long-term business strategies.

- Business Growth: Understanding the time and resources dedicated to different aspects of the business allows self-employed individuals to identify areas for improvement and optimize their operations for greater efficiency and profitability.

- Loan Applications: Financial institutions often require detailed records to assess the creditworthiness of self-employed individuals seeking loans. Accurate records demonstrate financial stability and increase the likelihood of loan approval.

- Legal Disputes: In the event of legal disputes, detailed records can provide irrefutable evidence to support claims or defend against accusations.

Understanding the Self-Employment Work Calendar (Form 126)

Form 126, or the self-employment work calendar, is a valuable tool for self-employed individuals to maintain a detailed record of their work activities. It typically includes the following elements:

- Date: This column records the specific date of each work activity.

- Description of Work: A brief but detailed description of the work performed on that particular day.

- Hours Worked: The total number of hours dedicated to each task or project.

- Client/Project Name: Identification of the specific client or project associated with the work performed.

- Income Received: Details of any income earned from the work, including the amount and payment method.

- Expenses Incurred: A record of all expenses related to the work, such as travel costs, materials, or professional fees.

The Importance of Regular Updates

Maintaining a self-employment work calendar requires consistent effort and discipline. It is crucial to update the calendar regularly, ideally on a daily or weekly basis. This ensures that all work activities are accurately captured and that the information remains current.

Tips for Effective Record Keeping

- Choose a System That Suits Your Needs: There are various methods for maintaining records, from traditional paper-based systems to digital spreadsheets and specialized accounting software. Select a system that is convenient and efficient for your individual needs.

- Be Consistent and Comprehensive: Maintain a consistent record-keeping routine and capture all relevant information, including income, expenses, and time spent on tasks.

- Keep Supporting Documentation: Retain receipts, invoices, and other supporting documentation to substantiate the entries in your self-employment work calendar.

- Regularly Review and Update: Periodically review your records to ensure accuracy and completeness. Make necessary adjustments as your business evolves.

- Seek Professional Advice: If you are unsure about the specific record-keeping requirements or have complex financial situations, consult with a tax advisor or accountant for personalized guidance.

Frequently Asked Questions (FAQs) Regarding Self-Employment Work Calendars

Q: Is it mandatory to use a self-employment work calendar?

A: While there is no legal requirement to use a self-employment work calendar, it is highly recommended for self-employed individuals to maintain accurate records. This helps ensure compliance with tax regulations and provides valuable financial insights.

Q: Can I use a digital spreadsheet instead of a paper-based calendar?

A: Yes, digital spreadsheets are a convenient and efficient alternative to paper-based calendars. Many free and paid spreadsheet software options are available, allowing for easy data entry, calculation, and organization.

Q: What if I forget to record a work activity?

A: If you realize you have missed a work activity, try to reconstruct the information as accurately as possible based on your memory or supporting documentation. Be transparent and honest with yourself and the relevant authorities about any omissions or inaccuracies.

Q: How long should I keep my records?

A: The IRS recommends keeping records for at least three years, but it is best to retain them for a longer duration, particularly for major expenses or income sources. This allows for potential audits and ensures you have access to relevant information if needed.

Conclusion

Maintaining accurate records is an essential aspect of self-employment. The self-employment work calendar, or Form 126, provides a valuable framework for tracking work activities, income, expenses, and time spent on various tasks. By diligently recording this information, self-employed individuals can streamline their tax compliance, gain valuable financial insights, and pave the way for sustainable business growth. While the journey of self-employment is often rewarding, it requires commitment and discipline, especially when it comes to record keeping. By embracing meticulous record-keeping practices, self-employed individuals can navigate the complexities of financial management and maximize their potential for success.

Closure

Thus, we hope this article has provided valuable insights into Understanding the Importance of Accurate Record Keeping for Self-Employed Individuals. We appreciate your attention to our article. See you in our next article!