Navigating the SFDPH Payroll Calendar: A Guide for 2025

Related Articles: Navigating the SFDPH Payroll Calendar: A Guide for 2025

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to Navigating the SFDPH Payroll Calendar: A Guide for 2025. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating the SFDPH Payroll Calendar: A Guide for 2025

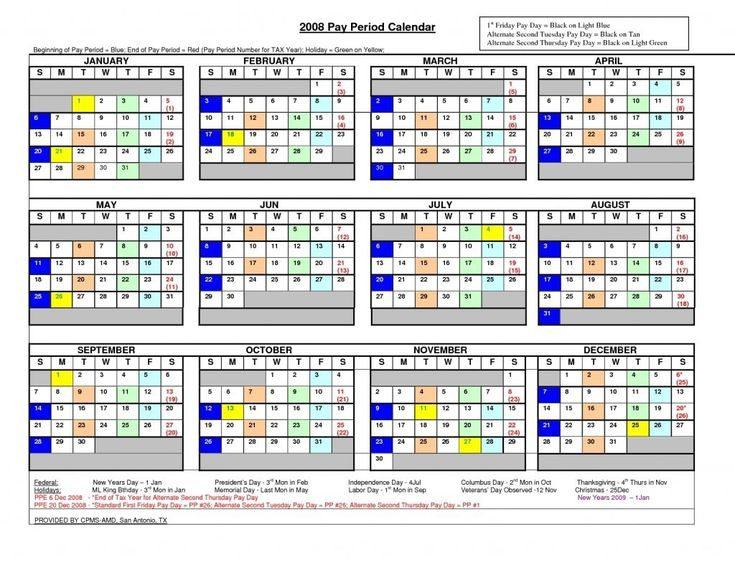

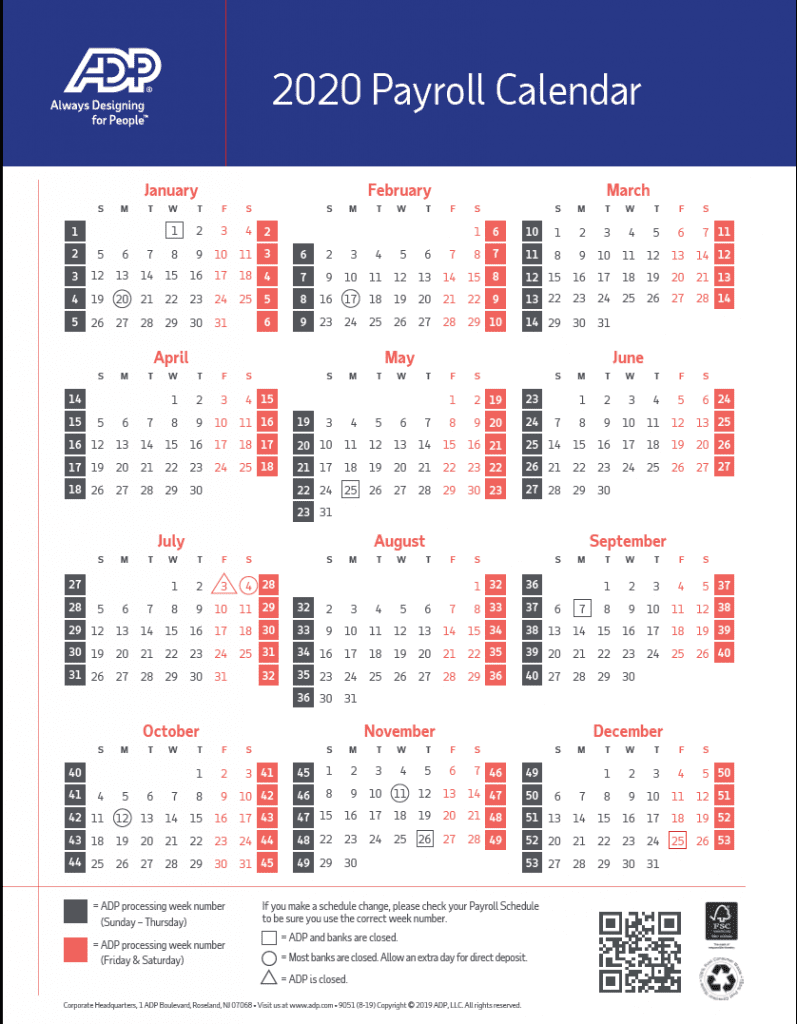

The San Francisco Department of Public Health (SFDPH) payroll calendar plays a crucial role in the smooth operation of the department. This calendar outlines the schedule for payroll processing, ensuring timely payment to employees and accurate financial management. Understanding the calendar’s intricacies is essential for both employees and department personnel.

Understanding the SFDPH Payroll Calendar

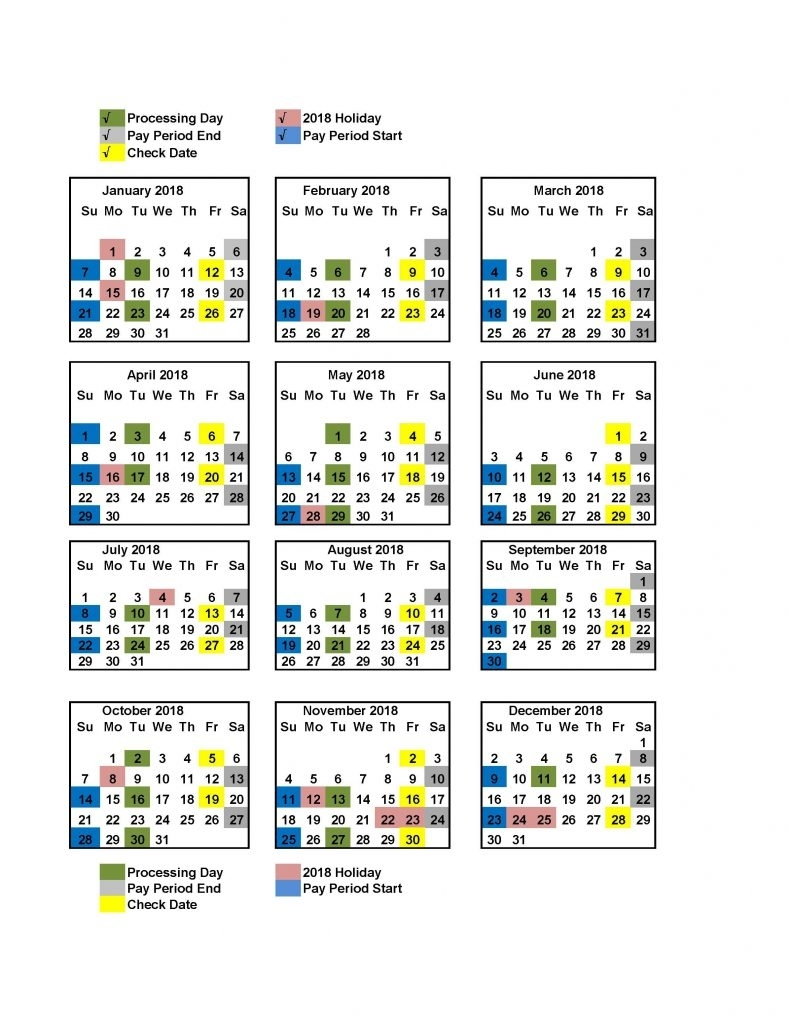

The SFDPH payroll calendar is a comprehensive document that provides a detailed schedule for payroll processing throughout the year. It outlines the following key information:

- Pay Dates: The exact dates when employees can expect to receive their paychecks.

- Payroll Cut-off Dates: The deadlines by which timekeeping information must be submitted to the payroll department for processing.

- Holiday Pay: The department’s policy regarding holiday pay, including applicable dates and payment procedures.

- Leave Accrual: Information on leave accrual rates and any relevant deadlines.

- Payroll Adjustments: Details on any anticipated payroll adjustments, such as tax changes or benefit adjustments.

Benefits of Using the SFDPH Payroll Calendar

Utilizing the SFDPH payroll calendar offers numerous benefits for both employees and department personnel:

- Financial Planning: Employees can effectively plan their finances by knowing the exact pay dates throughout the year.

- Time Management: By adhering to payroll cut-off dates, employees and managers can ensure timely submission of timekeeping information, preventing delays in payroll processing.

- Transparency and Accountability: The calendar promotes transparency in payroll operations, fostering trust and accountability between employees and the department.

- Reduced Errors: The clear and concise information presented in the calendar minimizes the potential for errors in payroll calculations and payments.

- Efficient Operations: The calendar streamlines payroll procedures, contributing to a more efficient and effective department.

Accessing the SFDPH Payroll Calendar

The SFDPH payroll calendar is typically accessible through the department’s intranet or employee portal. It is essential to consult the most recent version of the calendar, as it may be subject to updates throughout the year.

Frequently Asked Questions (FAQs)

Q: What happens if I miss the payroll cut-off date?

A: Missing the payroll cut-off date may result in a delay in your paycheck. It is crucial to submit timekeeping information promptly to avoid any issues.

Q: How are holiday pay and leave accrual calculated?

A: The SFDPH payroll calendar outlines the specific policies regarding holiday pay and leave accrual. Consult the calendar for detailed information on calculation methods and applicable dates.

Q: Can I access the payroll calendar from my mobile device?

A: The accessibility of the payroll calendar from mobile devices depends on the department’s platform. It is recommended to check the intranet or employee portal for mobile compatibility.

Q: Who can I contact if I have questions about the payroll calendar?

A: For any queries regarding the SFDPH payroll calendar, contact the department’s payroll department directly. Their contact information should be readily available on the intranet or employee portal.

Tips for Using the SFDPH Payroll Calendar Effectively

- Bookmark the Calendar: Save the link to the SFDPH payroll calendar on your browser for easy access.

- Set Reminders: Use calendar reminders or notification apps to ensure you meet payroll cut-off dates.

- Review Updates: Regularly check for updates to the calendar, as changes may occur throughout the year.

- Communicate with Payroll: If you encounter any issues or have questions, contact the payroll department promptly for clarification.

- Maintain Records: Keep copies of your pay stubs and any relevant payroll documentation for your records.

Conclusion

The SFDPH payroll calendar is a vital resource for both employees and department personnel. Understanding its contents and adhering to its schedule ensures timely and accurate payroll processing, contributing to a smooth and efficient departmental operation. By utilizing the calendar effectively and staying informed about any updates, individuals can manage their finances effectively and contribute to the overall success of the department.

Closure

Thus, we hope this article has provided valuable insights into Navigating the SFDPH Payroll Calendar: A Guide for 2025. We appreciate your attention to our article. See you in our next article!