Navigating the Future of Payroll: A Comprehensive Guide to 2025

Related Articles: Navigating the Future of Payroll: A Comprehensive Guide to 2025

Introduction

With great pleasure, we will explore the intriguing topic related to Navigating the Future of Payroll: A Comprehensive Guide to 2025. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating the Future of Payroll: A Comprehensive Guide to 2025

The year 2025 is rapidly approaching, and with it comes a landscape of evolving business practices and technological advancements. This is especially true in the realm of payroll, where efficiency, accuracy, and compliance are paramount. Understanding the key trends and advancements shaping payroll in 2025 is essential for organizations to optimize their operations and ensure smooth, compliant payroll processing.

The Shifting Landscape of Payroll in 2025

Several key factors are transforming the payroll landscape in 2025:

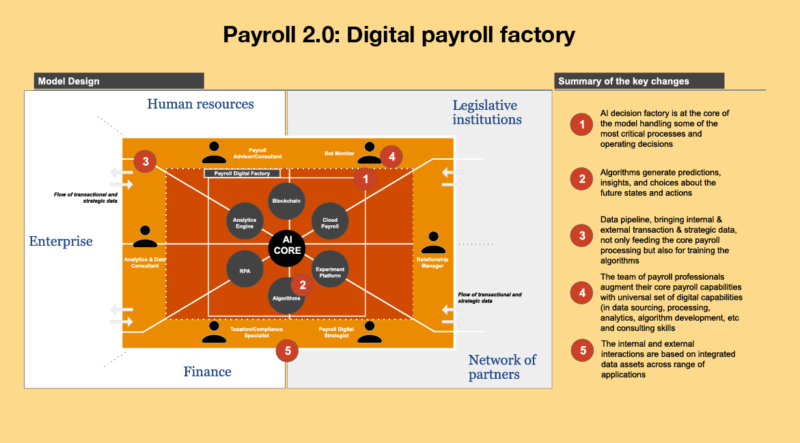

- The Rise of Automation: Artificial Intelligence (AI) and machine learning are revolutionizing payroll processes. Automation tools are streamlining tasks such as data entry, calculation, and reporting, freeing up human resources for strategic initiatives.

- The Importance of Data Security: Data breaches and cyberattacks are a growing concern. Organizations are investing heavily in robust security measures to protect sensitive employee data and ensure compliance with data privacy regulations.

- The Need for Flexibility: The workforce is becoming increasingly diverse and geographically dispersed. Payroll systems must adapt to support flexible work arrangements, including remote work, gig economy participation, and global teams.

- The Impact of Legislation: Changes in tax laws, labor regulations, and minimum wage requirements necessitate constant updates and adjustments to payroll systems to ensure compliance.

- The Focus on Employee Experience: Modern employees expect a seamless and transparent payroll experience. This includes easy access to pay stubs, accurate deductions, and timely payments.

Understanding the Benefits of a Modern Payroll Calendar

A well-structured payroll calendar is a cornerstone of efficient and compliant payroll processing. It provides a clear roadmap for all payroll-related activities, ensuring accuracy, timeliness, and adherence to legal requirements.

Key Benefits of a Modern Payroll Calendar:

- Improved Accuracy: A comprehensive calendar helps prevent errors by outlining specific deadlines and responsibilities for each payroll cycle.

- Enhanced Efficiency: By streamlining processes and establishing clear workflows, a payroll calendar minimizes delays and bottlenecks, optimizing operational efficiency.

- Increased Compliance: The calendar serves as a central repository for regulatory updates and deadlines, ensuring compliance with evolving labor laws and tax regulations.

- Enhanced Communication: It facilitates effective communication among payroll departments, HR teams, and employees, promoting transparency and reducing confusion.

- Better Financial Planning: A well-defined payroll calendar supports accurate budgeting and forecasting, allowing organizations to manage their financial resources effectively.

Navigating the Challenges: FAQs

1. What are the key challenges associated with implementing a modern payroll calendar?

- Resistance to Change: Some employees may resist adopting new technologies or workflows. Overcoming this resistance requires clear communication, training, and demonstrating the benefits of the new system.

- Data Integration: Integrating data from multiple systems can be complex. Organizations need to ensure seamless data flow between their payroll system, HR software, and other relevant platforms.

- Compliance with Ever-Changing Regulations: Keeping up with evolving labor laws, tax regulations, and data privacy rules requires constant monitoring and adaptation.

- Security Risks: Protecting sensitive employee data is paramount. Organizations must implement robust security measures to safeguard payroll information from cyber threats.

2. How can organizations effectively manage payroll changes in 2025?

- Embrace Technology: Invest in advanced payroll software solutions that incorporate AI, automation, and cloud-based functionalities to streamline processes and enhance accuracy.

- Focus on Employee Training: Provide comprehensive training to employees on the new payroll system and processes. This ensures a smooth transition and minimizes errors.

- Establish Clear Communication Channels: Maintain open and transparent communication with employees regarding payroll changes, deadlines, and any potential impacts.

- Seek Expert Guidance: Collaborate with experienced payroll professionals or consultants to navigate complex compliance issues, implement best practices, and stay ahead of industry trends.

3. What are the essential elements of a modern payroll calendar?

- Payroll Cycle Dates: Clearly defined dates for each payroll cycle, including pay dates, cutoff dates, and submission deadlines.

- Tax and Regulatory Deadlines: A comprehensive list of all relevant tax deadlines, reporting requirements, and other legal obligations.

- Employee Data Updates: Regular reminders and deadlines for updating employee information, such as address changes, tax withholdings, and benefit elections.

- Payroll Processing Steps: A detailed breakdown of each step in the payroll process, including data entry, verification, calculation, and payment.

- Communication Plan: A clear communication strategy for informing employees about payroll changes, deadlines, and relevant information.

4. How can organizations ensure data security and compliance in 2025?

- Implement Strong Access Controls: Limit access to sensitive payroll data to authorized personnel and enforce multi-factor authentication for all users.

- Regularly Update Security Software: Ensure all systems, software, and applications are regularly updated with the latest security patches to prevent vulnerabilities.

- Conduct Security Audits: Regularly conduct internal and external security audits to identify potential weaknesses and vulnerabilities in the payroll system.

- Comply with Data Privacy Regulations: Stay informed about evolving data privacy regulations, such as GDPR and CCPA, and implement measures to ensure compliance.

5. What are the key trends shaping the future of payroll?

- The Rise of Cloud-Based Payroll: Cloud-based payroll solutions offer scalability, flexibility, and enhanced security, making them increasingly popular among organizations.

- Integration with Other HR Systems: Payroll systems are becoming increasingly integrated with other HR software, such as time and attendance, benefits administration, and talent management platforms.

- The Growing Importance of Data Analytics: Organizations are leveraging data analytics to gain insights into payroll trends, identify potential cost savings, and improve decision-making.

- The Focus on Employee Self-Service: Employees are demanding greater control over their payroll information and processes. Modern payroll systems offer self-service portals for accessing pay stubs, updating personal information, and managing deductions.

Tips for Effective Payroll Management in 2025

- Invest in Technology: Embrace automation and AI-powered payroll solutions to streamline processes, improve accuracy, and free up valuable time for strategic initiatives.

- Prioritize Data Security: Implement robust security measures to protect sensitive employee data from cyber threats and ensure compliance with data privacy regulations.

- Stay Informed about Regulations: Regularly monitor changes in labor laws, tax regulations, and data privacy rules to ensure compliance and avoid penalties.

- Embrace Flexibility: Adapt to the evolving workforce by supporting flexible work arrangements and providing employees with the tools and resources they need to manage their payroll information.

- Focus on Employee Experience: Provide employees with a seamless and transparent payroll experience, including easy access to pay stubs, accurate deductions, and timely payments.

Conclusion

The payroll landscape in 2025 will be characterized by automation, data security, flexibility, and compliance. By embracing technology, prioritizing data security, and adapting to changing regulations, organizations can ensure efficient, accurate, and compliant payroll processing. A well-structured payroll calendar is an essential tool for achieving these goals, providing a roadmap for all payroll-related activities and ensuring a smooth and reliable payroll experience for employees.

![]()

Closure

Thus, we hope this article has provided valuable insights into Navigating the Future of Payroll: A Comprehensive Guide to 2025. We appreciate your attention to our article. See you in our next article!