Navigating the Fiscal Landscape: Understanding the Importance of a Fiscal Calendar

Related Articles: Navigating the Fiscal Landscape: Understanding the Importance of a Fiscal Calendar

Introduction

With great pleasure, we will explore the intriguing topic related to Navigating the Fiscal Landscape: Understanding the Importance of a Fiscal Calendar. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating the Fiscal Landscape: Understanding the Importance of a Fiscal Calendar

In the world of finance and accounting, maintaining a clear and organized system for tracking financial activities is paramount. Enter the fiscal calendar, a structured framework that defines a specific period for recording and reporting financial transactions.

Defining the Fiscal Calendar

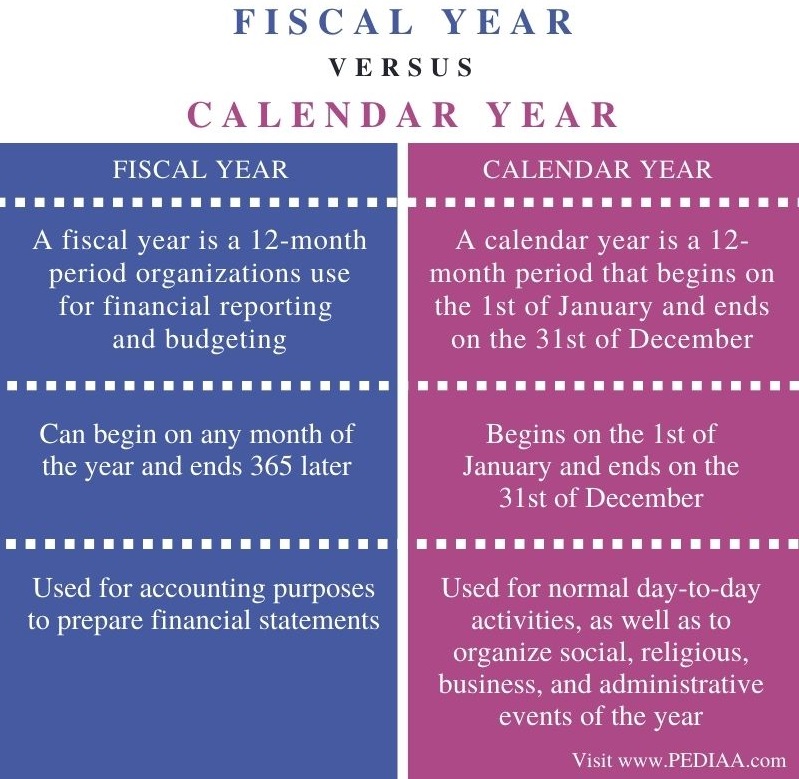

The fiscal calendar, often referred to as the fiscal year, is a 12-month period that a government, business, or organization uses for budgeting, accounting, and reporting purposes. It deviates from the standard calendar year (January 1 to December 31) and can begin on any date, depending on the entity’s specific needs and practices.

Why is a Fiscal Calendar Important?

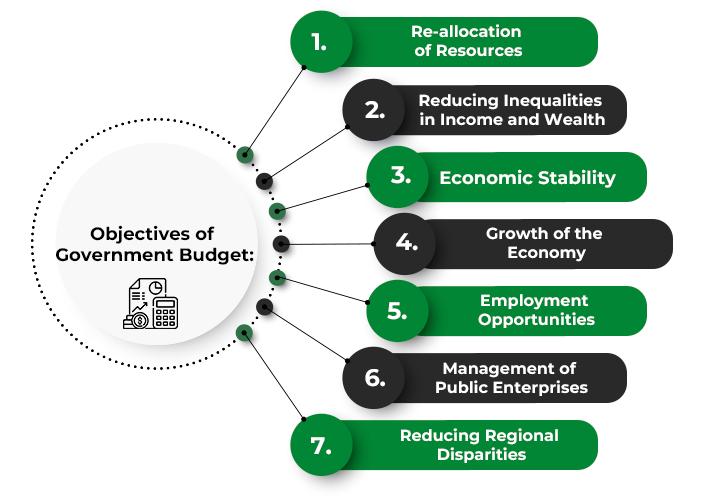

The fiscal calendar plays a crucial role in financial management, offering numerous benefits:

- Structured Budgeting: It provides a defined time frame for budgeting, allowing organizations to plan their expenses and revenue projections effectively.

- Accurate Financial Reporting: By establishing a clear accounting period, the fiscal calendar ensures consistency and accuracy in financial reporting, facilitating informed decision-making.

- Tax Compliance: It aligns with tax deadlines and reporting requirements, minimizing compliance risks and penalties.

- Performance Monitoring: It provides a framework for tracking financial performance throughout the year, enabling organizations to assess their progress and make necessary adjustments.

- Improved Coordination: It fosters better coordination between departments and stakeholders, as everyone works within the same financial framework.

Understanding the Fiscal Calendar’s Impact on Various Sectors

The fiscal calendar impacts various sectors, each with its unique implementation and significance:

Government:

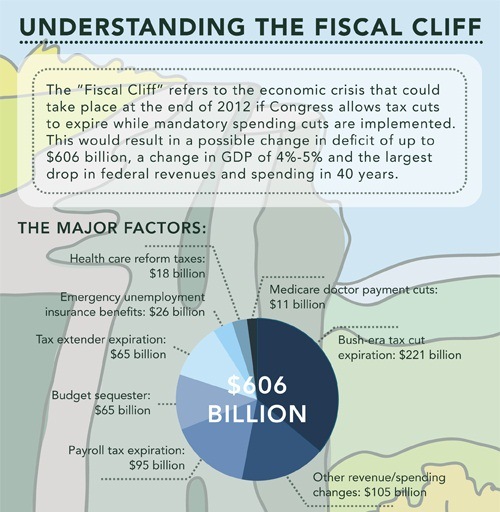

- Government Fiscal Year: Governments typically establish a fiscal year that aligns with their budgetary cycle and tax collection periods. This enables them to plan and execute public spending effectively, ensuring the efficient allocation of resources.

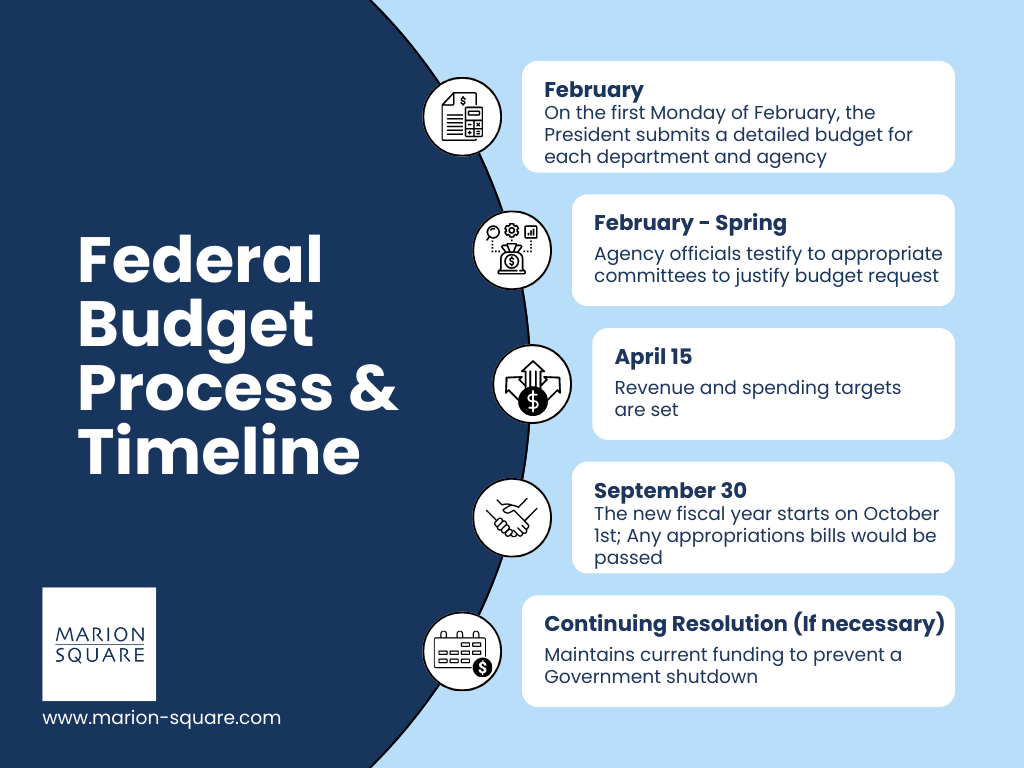

- Budgeting and Appropriations: The fiscal calendar dictates the timeframe for budget proposals, legislative approvals, and the disbursement of funds. This process ensures transparency and accountability in government spending.

- Tax Collection and Reporting: The fiscal year defines the tax filing deadlines and reporting requirements for individuals and businesses. It facilitates the smooth collection of tax revenue, essential for funding public services.

Business:

- Financial Reporting and Planning: Businesses use the fiscal calendar to align their financial reporting cycles, enabling them to track profitability, assess performance, and plan for future growth.

- Inventory Management: By understanding the seasonal fluctuations and demand patterns, businesses can optimize inventory management and minimize storage costs.

- Investment Decisions: The fiscal calendar informs investment decisions, as businesses can analyze their financial performance and identify opportunities for growth or expansion.

Non-Profit Organizations:

- Fundraising and Grant Cycles: Non-profit organizations often align their fiscal calendar with major fundraising events and grant cycles, ensuring a consistent flow of funding.

- Program Planning and Evaluation: It provides a framework for planning and evaluating programs, allowing organizations to track their impact and allocate resources efficiently.

- Donor Reporting: The fiscal calendar dictates the reporting requirements for donors, ensuring transparency and accountability in the use of charitable funds.

Common Fiscal Calendar Variations

While the fiscal calendar typically spans 12 months, there are variations in its starting date:

- July 1st: Many businesses and organizations adopt a fiscal year that begins on July 1st, aligning with the end of the academic year and allowing for a comprehensive review of the previous year’s activities.

- October 1st: This fiscal year aligns with the start of the federal government’s fiscal year, offering consistency for organizations that work closely with government agencies.

- Other Dates: Some businesses, particularly those with specific industry needs, may choose a fiscal year that starts on a different date, such as the beginning of their peak season.

Navigating the Fiscal Calendar: Best Practices and Tips

- Establish a Clear Fiscal Calendar: Define the starting and ending dates of your fiscal year and communicate it clearly to all stakeholders.

- Align with Industry Standards: Consider industry best practices and align your fiscal calendar with common industry standards to facilitate communication and collaboration.

- Regularly Review and Update: Periodically review and update your fiscal calendar to ensure it remains relevant and meets your changing business needs.

- Utilize Technology: Leverage accounting software and financial management tools to streamline financial processes and automate reporting tasks.

- Communicate Effectively: Maintain clear communication with stakeholders regarding the fiscal calendar, ensuring everyone is aware of deadlines and reporting requirements.

FAQs: Demystifying the Fiscal Calendar

Q1: What is the difference between a fiscal year and a calendar year?

A1: A fiscal year is a 12-month period used for accounting and budgeting purposes, while a calendar year runs from January 1st to December 31st. The fiscal year can start on any date, depending on the organization’s needs.

Q2: Why do governments use a different fiscal year than the calendar year?

A2: Governments use a separate fiscal year to align with their budgetary cycle, tax collection periods, and other financial obligations. It allows for a structured approach to managing public funds and ensures accountability in government spending.

Q3: How does the fiscal calendar impact businesses?

A3: The fiscal calendar influences various business operations, including financial reporting, budgeting, inventory management, and investment decisions. It helps businesses track their performance, plan for the future, and comply with tax regulations.

Q4: Can businesses change their fiscal year?

A4: Businesses can change their fiscal year, but it requires careful planning and consideration of potential implications for financial reporting, tax compliance, and stakeholder communication.

Q5: What are the benefits of using a fiscal calendar?

A5: A fiscal calendar provides a structured framework for financial management, enabling organizations to plan their budgets, track performance, comply with tax regulations, and improve coordination among stakeholders.

Conclusion:

The fiscal calendar serves as a vital tool for financial management, providing a structured framework for budgeting, reporting, and planning. By understanding its importance and implementing best practices, organizations can enhance their financial efficiency, transparency, and accountability. From governments to businesses and non-profits, the fiscal calendar plays a crucial role in navigating the complexities of financial operations and ensuring long-term financial stability.

Closure

Thus, we hope this article has provided valuable insights into Navigating the Fiscal Landscape: Understanding the Importance of a Fiscal Calendar. We thank you for taking the time to read this article. See you in our next article!