Navigating the Fiscal Landscape: A Comprehensive Guide to State Fiscal Year Calendars

Related Articles: Navigating the Fiscal Landscape: A Comprehensive Guide to State Fiscal Year Calendars

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to Navigating the Fiscal Landscape: A Comprehensive Guide to State Fiscal Year Calendars. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating the Fiscal Landscape: A Comprehensive Guide to State Fiscal Year Calendars

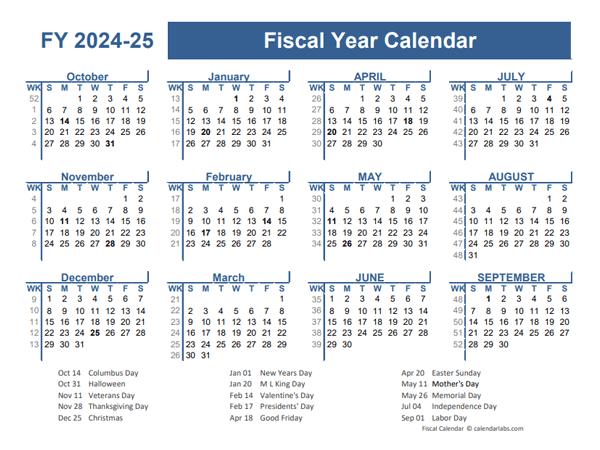

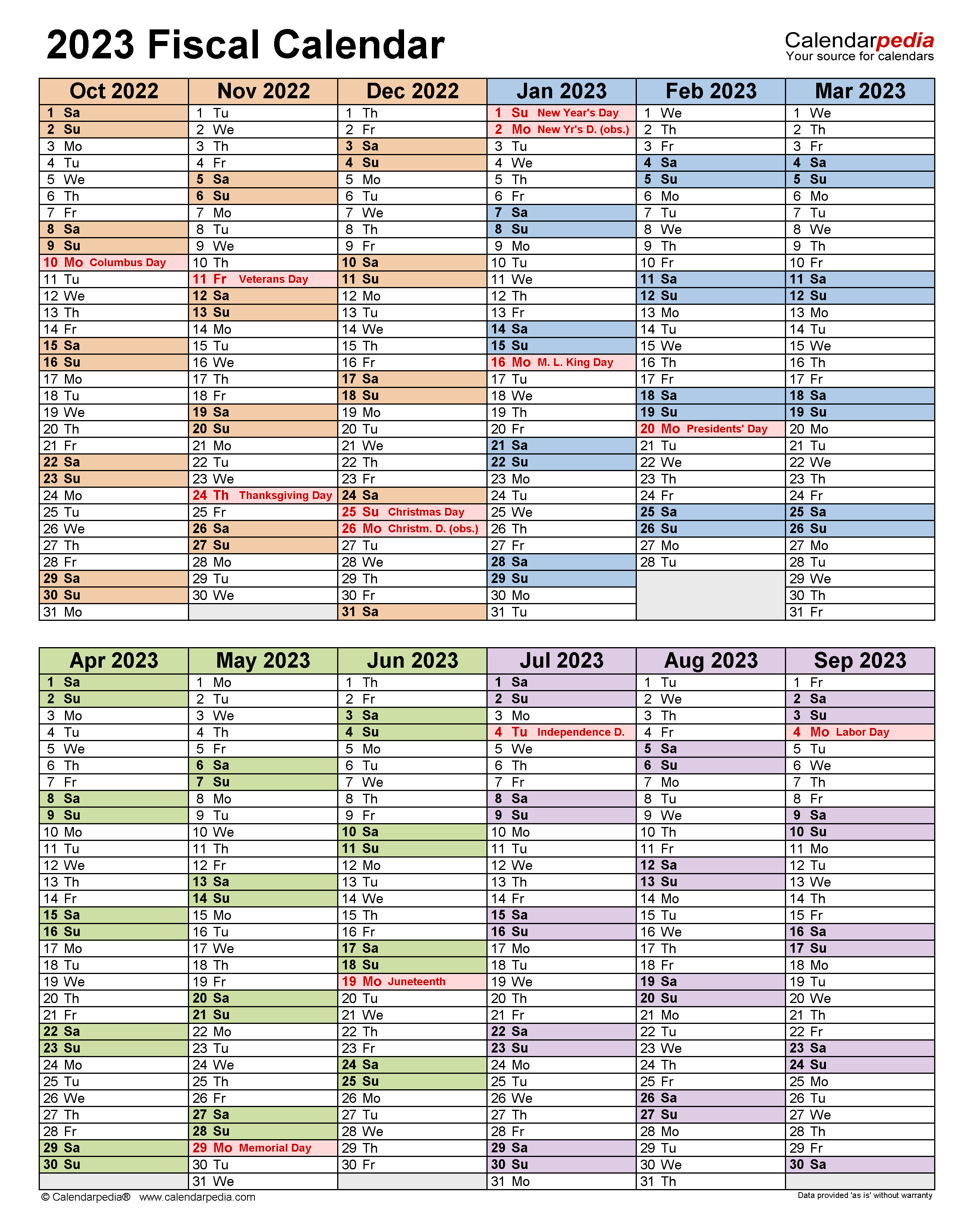

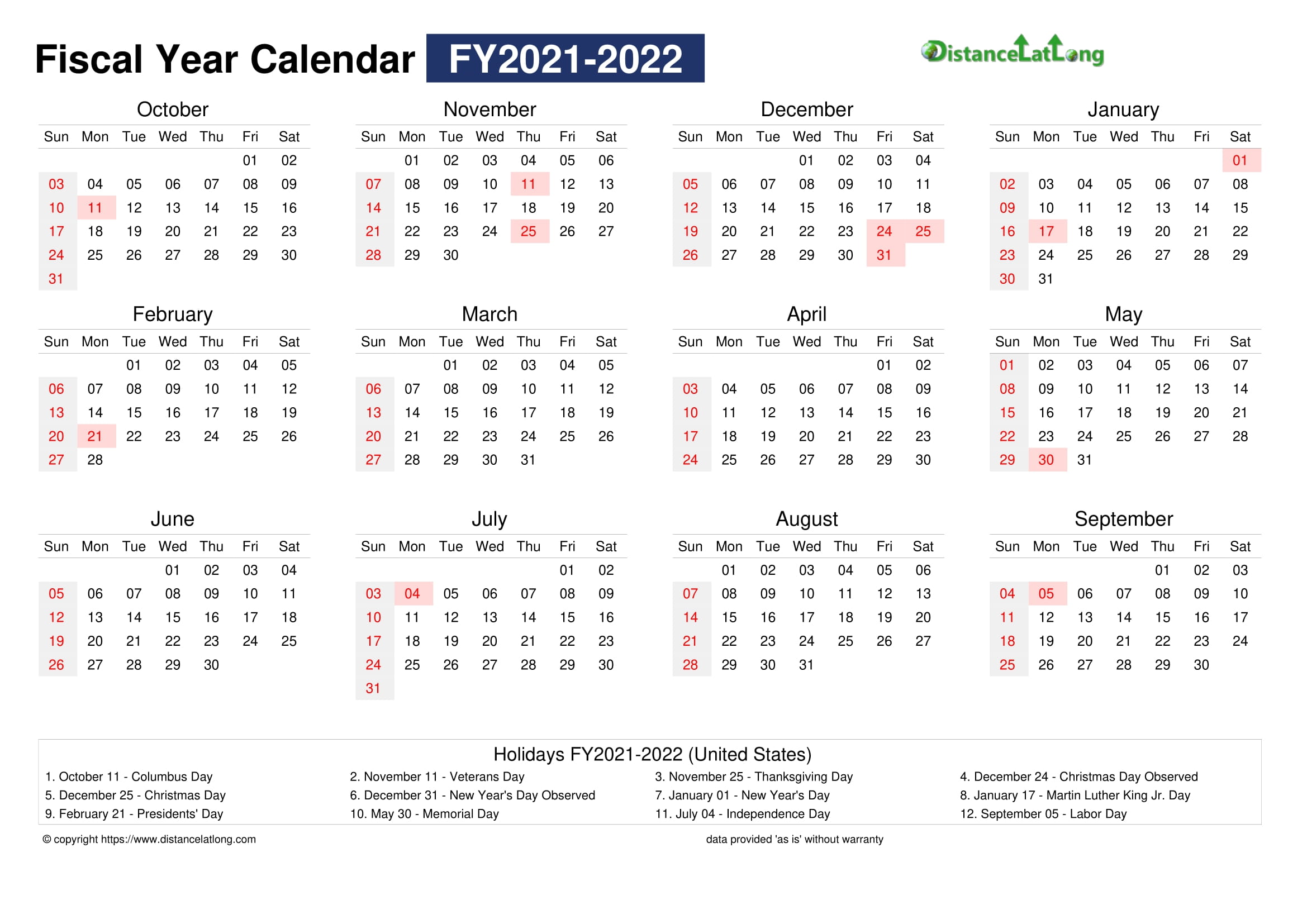

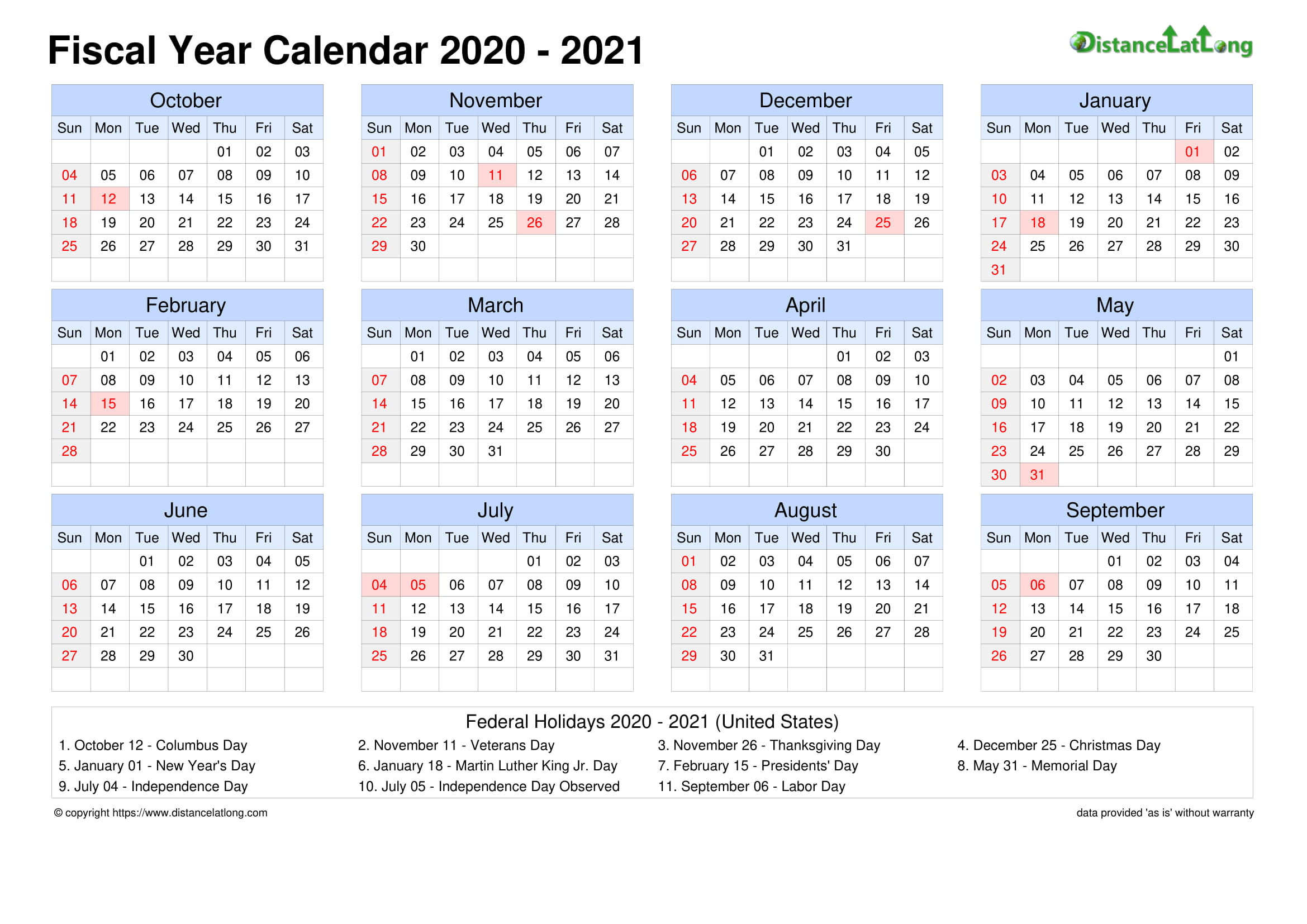

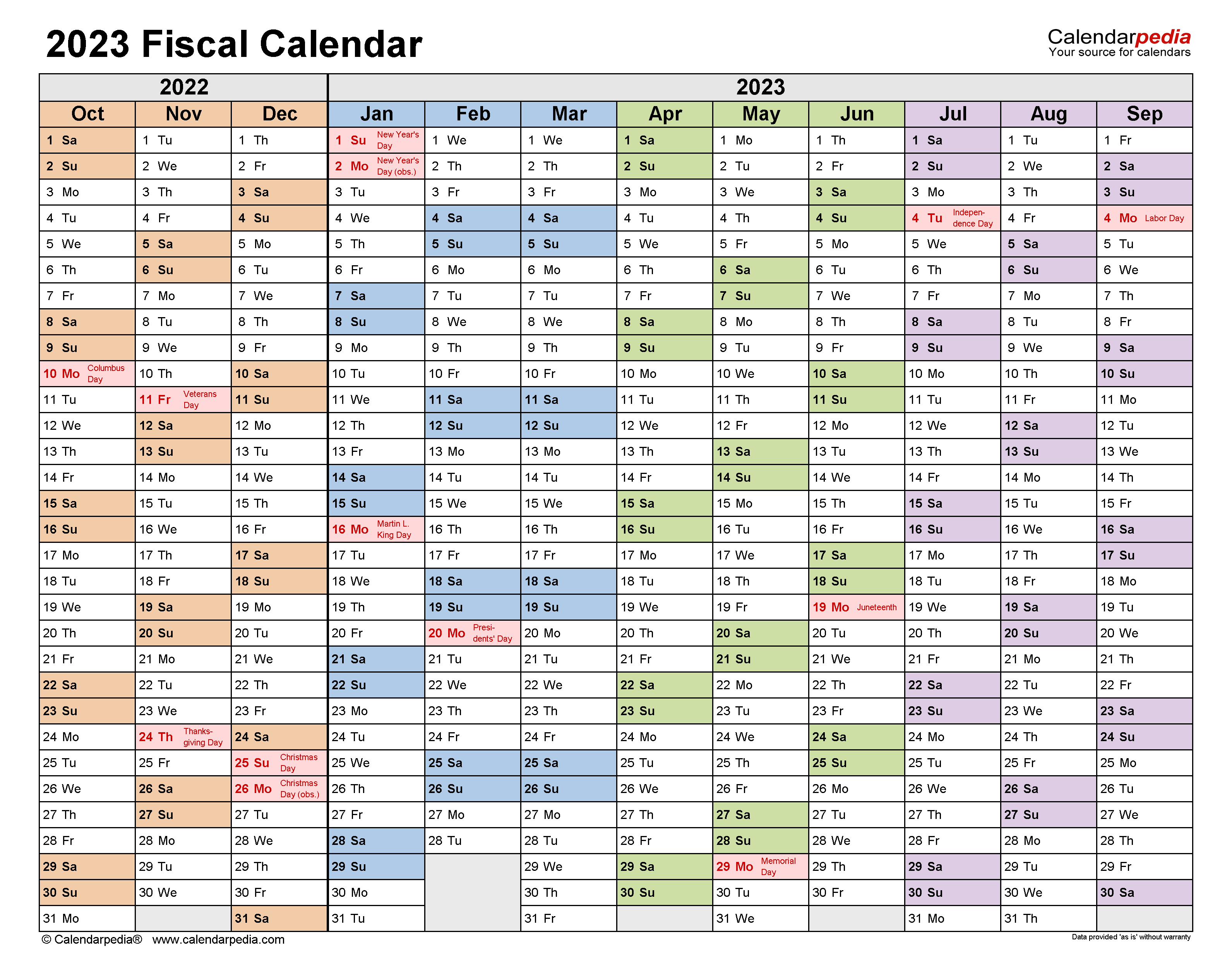

The fiscal year, a distinct accounting period used by governments and organizations, often diverges from the conventional calendar year (January 1 to December 31). State fiscal year calendars, in particular, play a crucial role in managing public finances, setting budget cycles, and ensuring accountability in public spending. Understanding the intricacies of these calendars is essential for individuals and organizations interacting with state governments, including businesses, nonprofits, and citizens.

This comprehensive guide explores the concept of state fiscal year calendars, delving into their structure, significance, and practical implications. We will examine how these calendars differ from state to state, discuss their impact on various stakeholders, and provide valuable insights for navigating the complexities of state government finances.

Defining the State Fiscal Year Calendar:

A state fiscal year calendar represents the period used by a state government to track its revenue and expenditures. Unlike the standard calendar year, which follows a fixed 12-month cycle, state fiscal years often begin and end on different dates. This variation stems from historical practices, budgetary considerations, and the unique needs of each state.

Understanding the Importance of State Fiscal Year Calendars:

The state fiscal year calendar serves as the foundation for a state’s financial management system. It dictates the timing of key budget processes, including:

- Budget Development: State agencies prepare budget requests based on the fiscal year calendar, outlining their spending needs and anticipated revenue streams.

- Legislative Appropriation: State legislatures review and approve the budget, allocating funds to various programs and services.

- Financial Reporting: State governments are required to provide regular financial reports, tracking their revenue and expenditure performance against the approved budget.

- Tax Filing Deadlines: The fiscal year calendar influences tax filing deadlines for individuals and businesses, affecting their financial obligations to the state.

Exploring the Variations in State Fiscal Year Calendars:

State fiscal year calendars exhibit significant diversity across the United States. While some states align their fiscal year with the calendar year (July 1 to June 30), others adopt unique start and end dates.

Examples of State Fiscal Year Calendars:

- California: July 1 to June 30

- Texas: September 1 to August 31

- New York: April 1 to March 31

- Florida: July 1 to June 30

These variations are often rooted in historical factors, the state’s economic activities, or the desire to synchronize with federal fiscal cycles.

The Impact of State Fiscal Year Calendars on Stakeholders:

State fiscal year calendars influence a wide range of stakeholders, impacting their operations, planning, and financial management.

- State Agencies: Agencies must align their budgeting, spending, and reporting activities with the state’s fiscal year calendar.

- Businesses: Businesses operating within a state must adhere to the state’s tax filing deadlines and reporting requirements, which are often tied to the fiscal year calendar.

- Nonprofits: Nonprofits receiving state grants or funding are subject to the state’s fiscal year calendar, influencing their grant cycles and reporting obligations.

- Citizens: State residents are impacted by the fiscal year calendar through tax deadlines, the availability of public services, and the timing of government programs.

Navigating the State Fiscal Year Calendar: Practical Tips and Resources:

Understanding and navigating the state fiscal year calendar is crucial for effective interaction with state government. Here are some practical tips and resources:

- Consult Official State Websites: State government websites provide comprehensive information on their fiscal year calendars, including budget documents, tax deadlines, and relevant legislation.

- Utilize State Agencies’ Contact Information: Reach out to relevant state agencies for clarification on specific questions regarding fiscal year deadlines, reporting requirements, and program timelines.

- Seek Professional Advice: Consult with financial advisors, accountants, or legal professionals for expert guidance on navigating the complexities of state fiscal year calendars and their implications for your specific situation.

Frequently Asked Questions (FAQs):

Q: Why do state fiscal year calendars vary from the standard calendar year?

A: State fiscal year calendars are often set based on historical practices, budgetary considerations, and the unique needs of each state. For example, some states choose to align their fiscal year with the federal government’s fiscal year (October 1 to September 30) to facilitate intergovernmental coordination.

Q: How do I find the fiscal year calendar for a specific state?

A: The most reliable source for information on a state’s fiscal year calendar is the official website of the state government. The state’s Department of Finance or a similar agency typically provides this information.

Q: What are the implications of the state fiscal year calendar for businesses?

A: Businesses operating within a state must adhere to the state’s tax filing deadlines and reporting requirements, which are often tied to the fiscal year calendar. Businesses should be aware of these deadlines to ensure compliance and avoid penalties.

Q: How do state fiscal year calendars impact nonprofits?

A: Nonprofits receiving state grants or funding are subject to the state’s fiscal year calendar, influencing their grant cycles and reporting obligations. Nonprofits should carefully consider the state’s fiscal year when applying for grants and managing their finances.

Conclusion:

State fiscal year calendars are essential components of state government financial management. Understanding their structure, variations, and impact on stakeholders is critical for effective interaction with state agencies, businesses, nonprofits, and citizens. By staying informed about the state’s fiscal year calendar, individuals and organizations can navigate the complexities of public finance and ensure compliance with relevant regulations and deadlines.

Closure

Thus, we hope this article has provided valuable insights into Navigating the Fiscal Landscape: A Comprehensive Guide to State Fiscal Year Calendars. We hope you find this article informative and beneficial. See you in our next article!