Navigating the Federal Pay Calendar: A Comprehensive Guide for 2025

Related Articles: Navigating the Federal Pay Calendar: A Comprehensive Guide for 2025

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to Navigating the Federal Pay Calendar: A Comprehensive Guide for 2025. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

- 1 Related Articles: Navigating the Federal Pay Calendar: A Comprehensive Guide for 2025

- 2 Introduction

- 3 Navigating the Federal Pay Calendar: A Comprehensive Guide for 2025

- 3.1 The Foundation of the Federal Pay Calendar: Bi-Weekly Pay Periods

- 3.2 Understanding the 2025 Federal Pay Calendar: Key Dates and Their Significance

- 3.3 Benefits of Understanding the Federal Pay Calendar

- 3.4 FAQs Regarding the Federal Pay Calendar: Addressing Common Concerns

- 3.5 Tips for Utilizing the Federal Pay Calendar Effectively

- 3.6 Conclusion: Embracing the Importance of the Federal Pay Calendar

- 4 Closure

Navigating the Federal Pay Calendar: A Comprehensive Guide for 2025

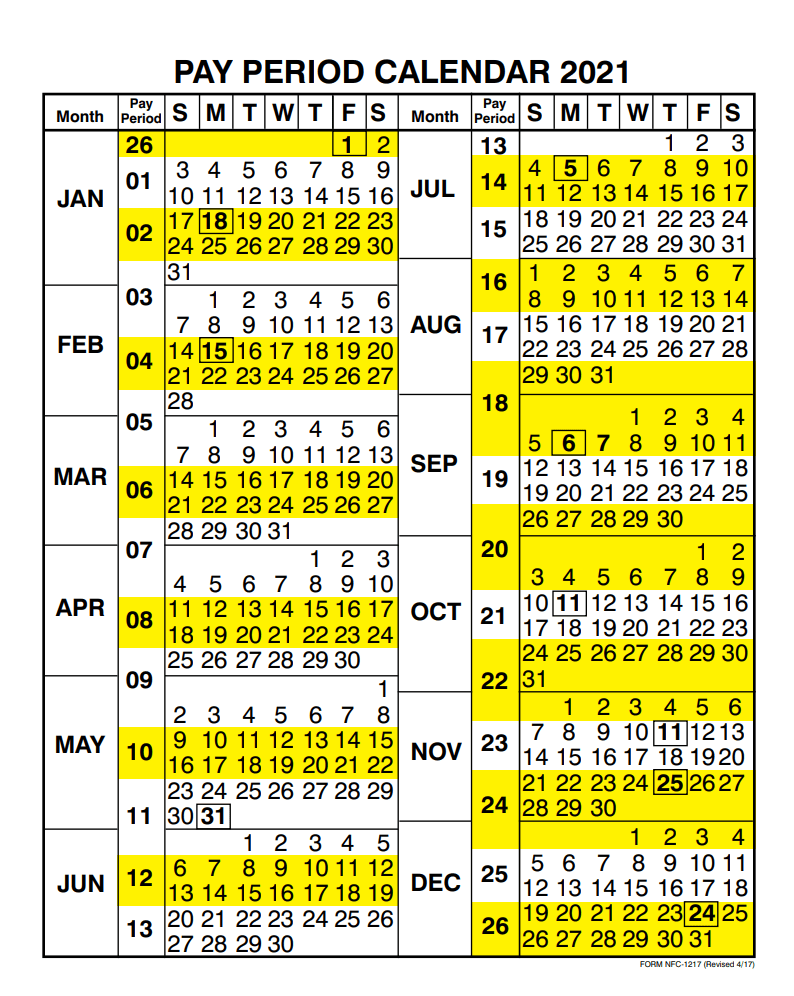

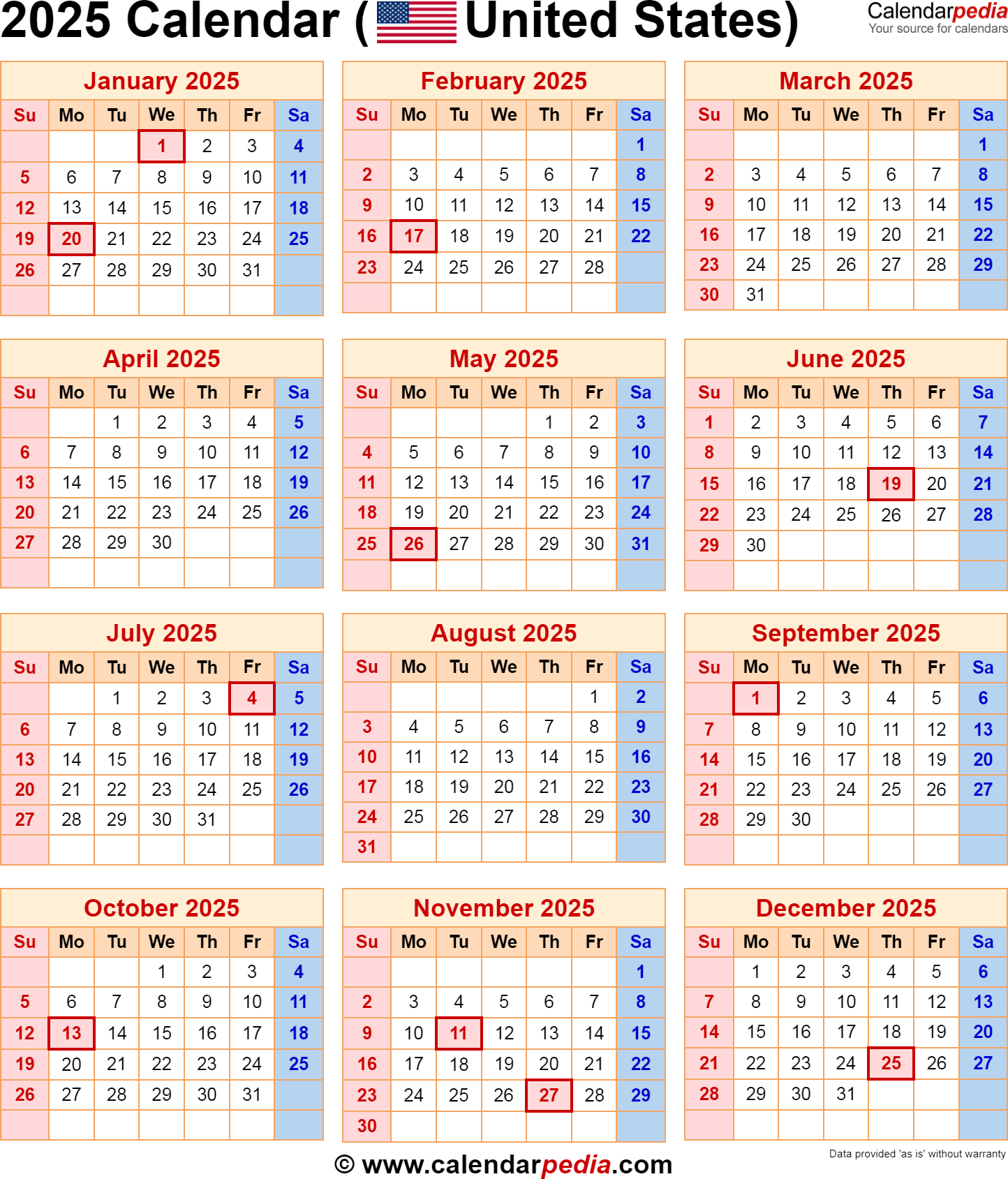

The federal government, as a significant employer, operates on a distinct pay schedule, known as the "bi-weekly pay period." Understanding this calendar is crucial for federal employees, as it dictates when they receive their salaries, impacts the timing of tax deductions, and influences the planning of personal finances. This article provides a detailed breakdown of the 2025 federal pay calendar, explaining its structure, key dates, and implications for federal employees.

The Foundation of the Federal Pay Calendar: Bi-Weekly Pay Periods

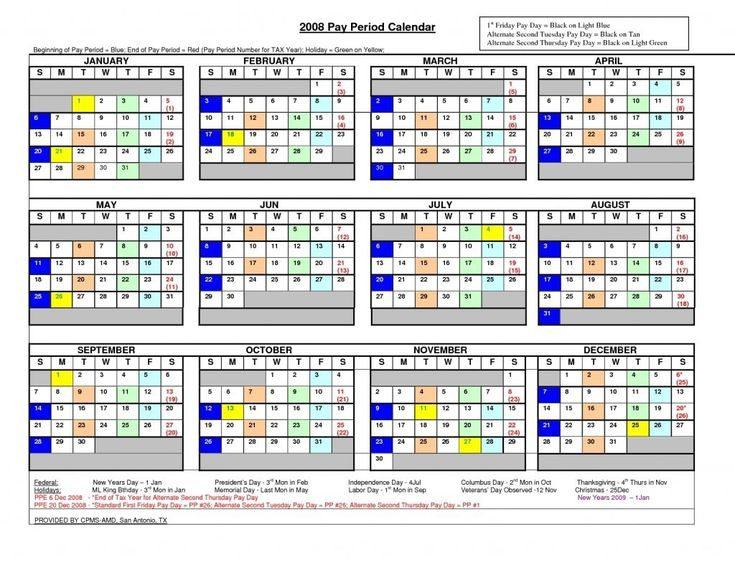

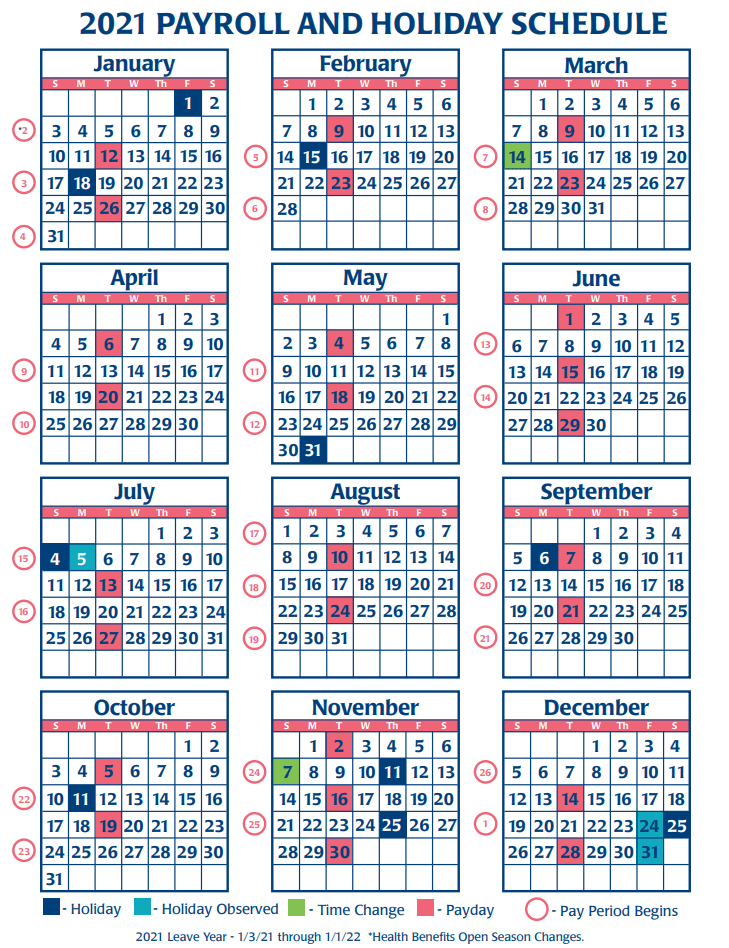

The federal government utilizes a bi-weekly pay period system, meaning employees are paid every two weeks. Each pay period is assigned a specific number, ranging from 1 to 26, with each year comprising 26 pay periods. The calendar for each year is published in advance, allowing federal employees to anticipate their pay dates and plan their finances accordingly.

Understanding the 2025 Federal Pay Calendar: Key Dates and Their Significance

The 2025 federal pay calendar, like its predecessors, is a critical tool for federal employees. It outlines the specific dates on which paychecks will be issued, providing a clear framework for budgeting and financial planning.

Here are some key aspects of the 2025 calendar and their significance:

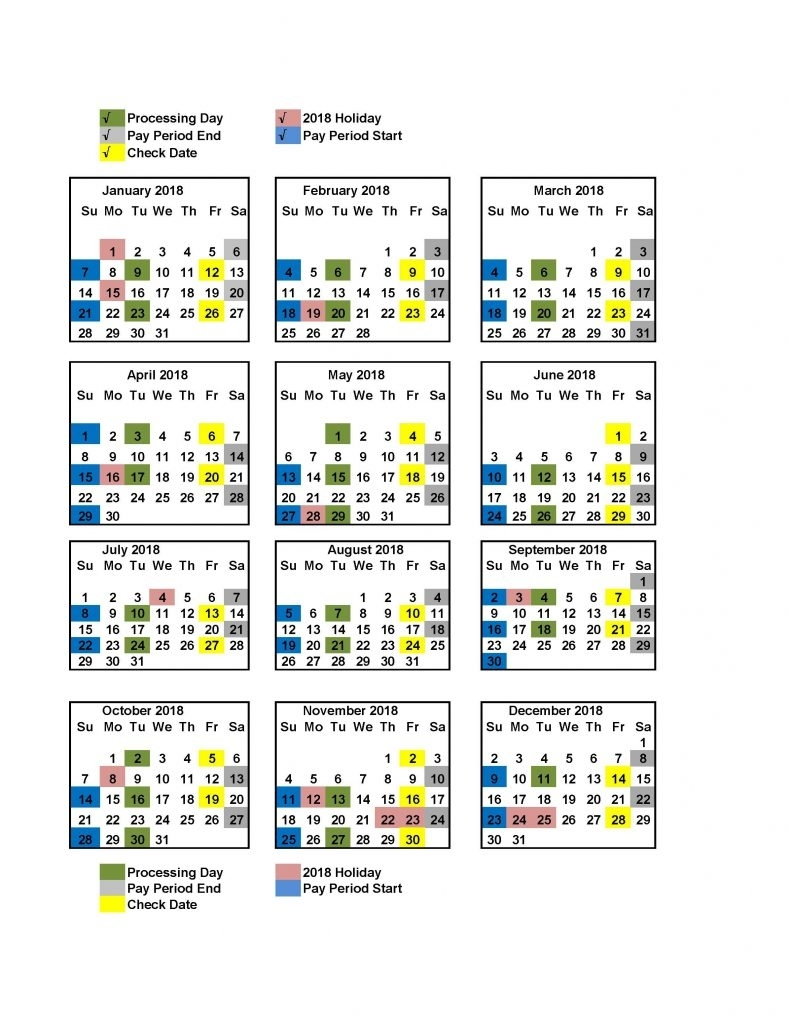

- Pay Dates: The calendar clearly specifies the exact dates on which each pay period’s salary will be deposited into employees’ accounts. This predictability is crucial for budgeting, as employees can accurately plan their expenses based on the known pay dates.

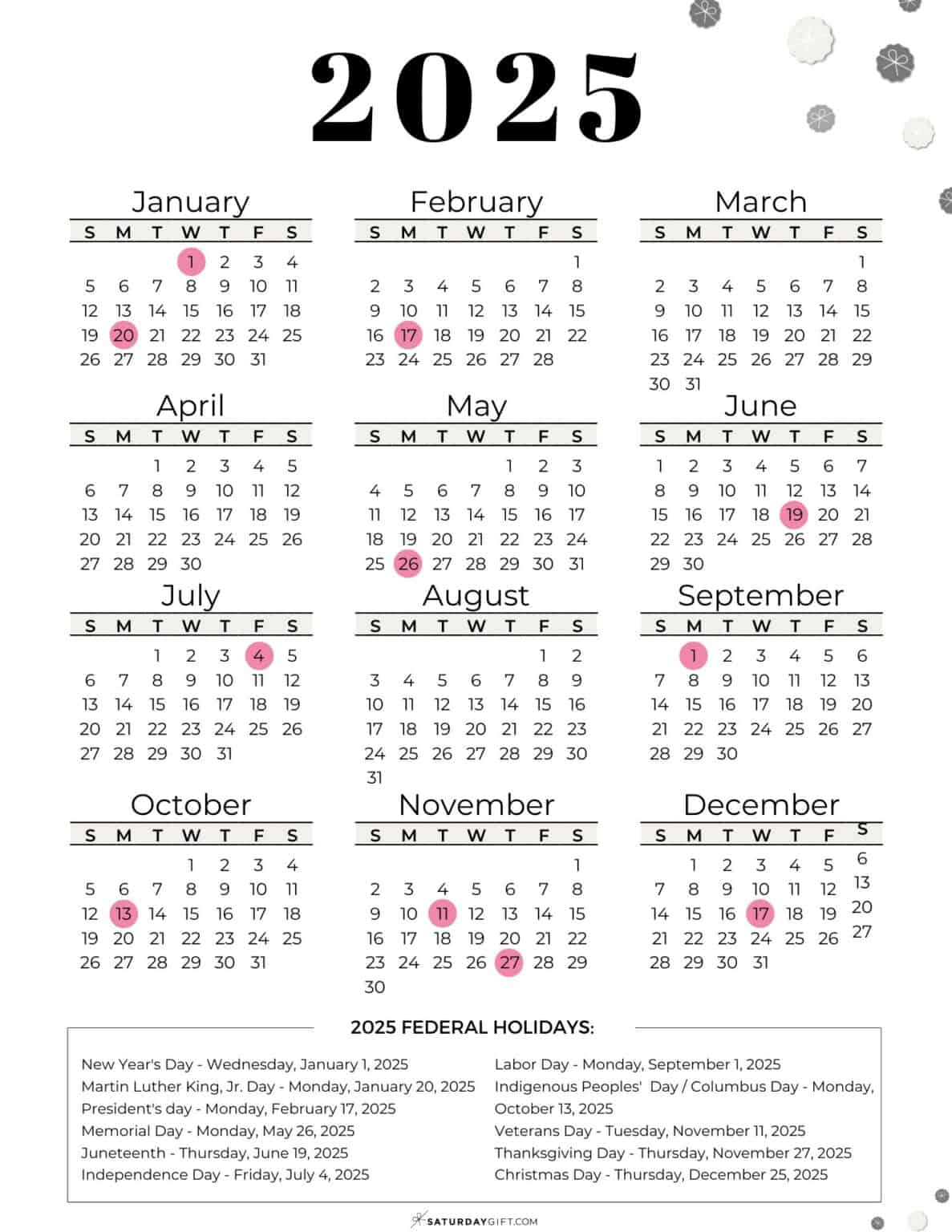

- Holidays: Federal holidays are incorporated into the calendar, influencing the timing of paychecks. For instance, if a pay date falls on a holiday, the paycheck is typically issued on the preceding working day. This information is essential for employees to adjust their financial planning around holiday periods.

- Tax Deductions: The pay calendar also informs employees about the timing of tax deductions. Understanding this aspect is crucial for accurate financial management, as it allows employees to factor in the impact of tax deductions on their net income.

- Leave Accrual: The calendar can be used to track leave accrual, as leave is typically calculated based on the number of pay periods worked. Employees can use this information to plan their vacation time or other leave periods.

Benefits of Understanding the Federal Pay Calendar

Beyond its role in salary disbursement, the federal pay calendar offers several benefits for federal employees:

- Enhanced Financial Planning: The calendar provides a clear framework for budgeting, enabling employees to plan their expenses based on predictable pay dates. This reduces the risk of financial instability and promotes responsible financial management.

- Effective Time Management: By knowing the pay dates, employees can better manage their time and prioritize financial obligations, leading to reduced stress and increased efficiency.

- Accurate Leave Planning: The calendar facilitates the planning of leave periods by allowing employees to track their leave accrual based on pay periods. This ensures that employees can take time off without disrupting their financial stability.

- Improved Communication: The calendar serves as a common point of reference for employees and their supervisors, fostering better communication regarding pay dates, leave accrual, and other financial matters.

FAQs Regarding the Federal Pay Calendar: Addressing Common Concerns

1. Where can I find the 2025 Federal Pay Calendar?

The 2025 federal pay calendar is typically published by the Office of Personnel Management (OPM) and is available on their official website. It is also often distributed through employee newsletters and internal communication channels.

2. What happens if a pay date falls on a weekend or holiday?

If a pay date falls on a weekend or holiday, the paycheck is usually issued on the preceding working day. This information is typically included in the published pay calendar.

3. How does the pay calendar affect my leave accrual?

Leave accrual is usually calculated based on the number of pay periods worked. The pay calendar helps employees track their leave accrual and plan their leave periods accordingly.

4. Can I get a pay advance if I need money before my pay date?

The availability of pay advances varies depending on the specific agency and its policies. It is advisable to consult with your agency’s Human Resources department for information on pay advance options.

5. What are the implications of the pay calendar for tax deductions?

The pay calendar indicates the timing of tax deductions. Understanding this aspect allows employees to factor in the impact of deductions on their net income and plan their finances accordingly.

Tips for Utilizing the Federal Pay Calendar Effectively

- Mark Important Dates: Mark key dates such as pay dates, holidays, and leave periods on your calendar to ensure you are aware of financial deadlines and potential changes in your income.

- Set Reminders: Set reminders for upcoming pay dates and important financial obligations to avoid missing deadlines and potential late fees.

- Budgeting Tools: Utilize budgeting tools like spreadsheets or financial apps to track your income and expenses based on the pay calendar. This promotes responsible spending and financial planning.

- Communication: Communicate with your supervisor or HR department about any potential changes in your pay schedule or leave accrual to ensure accurate financial planning.

- Stay Updated: Regularly check for updates or changes to the pay calendar, as adjustments may occur due to unforeseen circumstances.

Conclusion: Embracing the Importance of the Federal Pay Calendar

The federal pay calendar is a vital tool for federal employees, providing a clear framework for financial planning, leave management, and overall financial stability. Understanding the calendar’s structure, key dates, and implications allows employees to anticipate their income, plan their expenses, and manage their finances effectively. By proactively utilizing the information provided by the calendar, federal employees can navigate their financial obligations with greater confidence and ensure their financial well-being.

Closure

Thus, we hope this article has provided valuable insights into Navigating the Federal Pay Calendar: A Comprehensive Guide for 2025. We thank you for taking the time to read this article. See you in our next article!