Navigating the 5% Cash Back Chase Calendar: A Guide to Maximizing Your Rewards

Related Articles: Navigating the 5% Cash Back Chase Calendar: A Guide to Maximizing Your Rewards

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to Navigating the 5% Cash Back Chase Calendar: A Guide to Maximizing Your Rewards. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

- 1 Related Articles: Navigating the 5% Cash Back Chase Calendar: A Guide to Maximizing Your Rewards

- 2 Introduction

- 3 Navigating the 5% Cash Back Chase Calendar: A Guide to Maximizing Your Rewards

- 3.1 Understanding the 5% Cash Back Calendar Mechanics

- 3.2 5% Cash Back Calendar: A Detailed Guide

- 3.3 Leveraging the 5% Cash Back Calendar for Maximum Rewards

- 3.4 FAQs: 5% Cash Back Chase Calendar

- 3.5 Tips for Utilizing the 5% Cash Back Calendar Effectively

- 3.6 Conclusion: The 5% Cash Back Chase Calendar – A Valuable Tool for Rewards

- 4 Closure

Navigating the 5% Cash Back Chase Calendar: A Guide to Maximizing Your Rewards

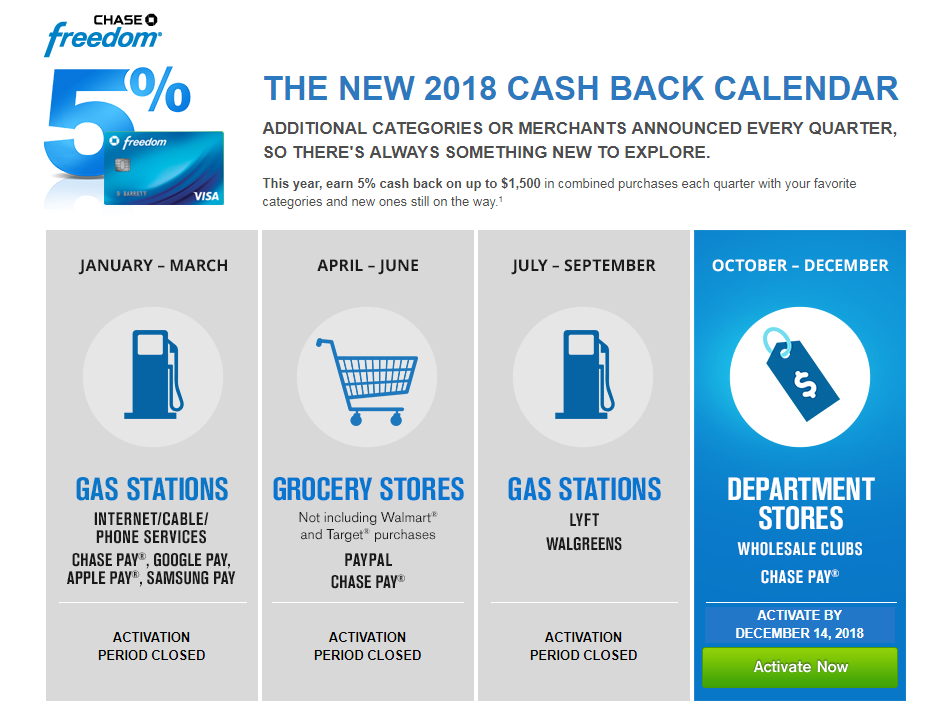

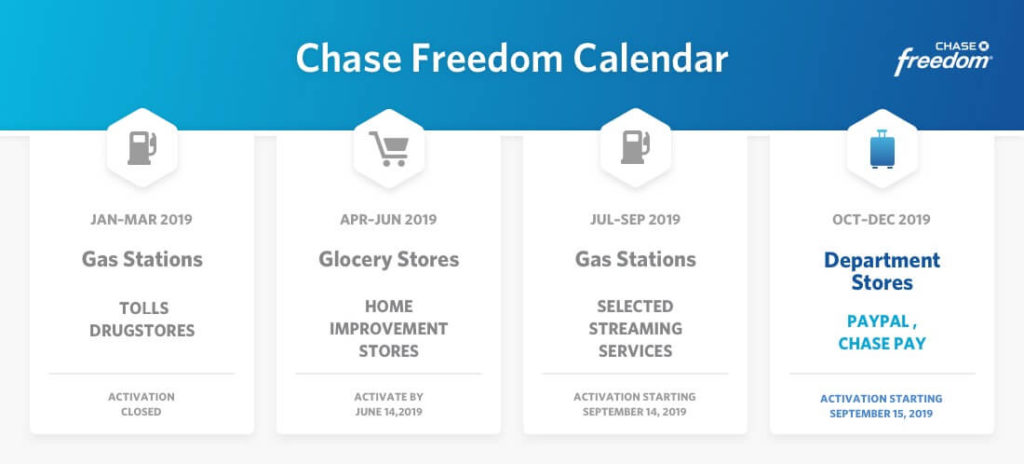

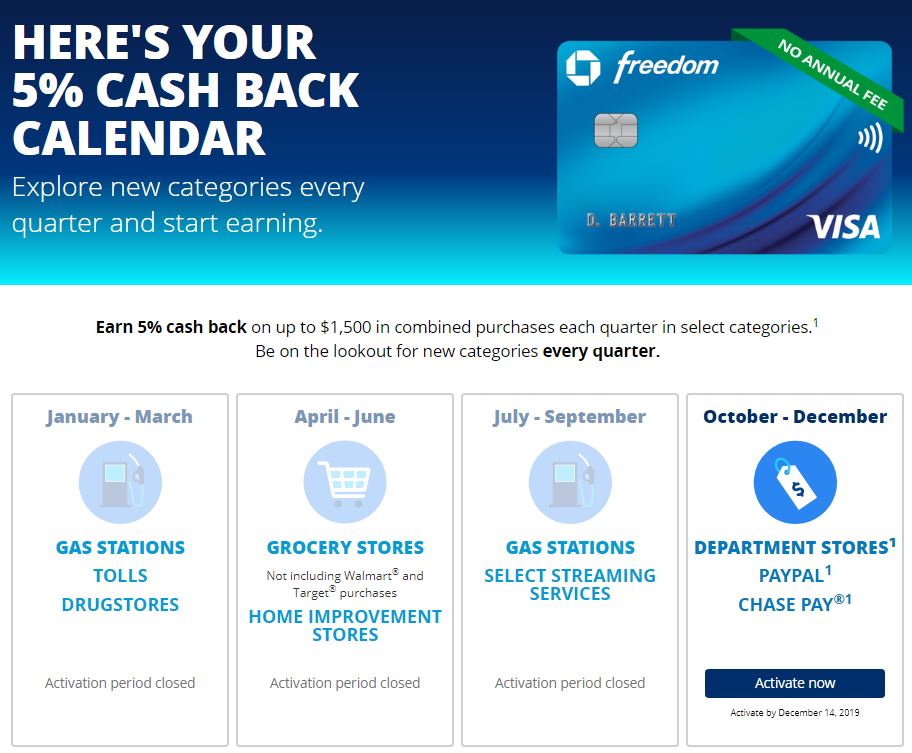

The Chase 5% cash back calendar is a popular feature for Chase Freedom and Freedom Unlimited cardholders, offering the potential to significantly boost their rewards earnings. This calendar, updated quarterly, designates specific bonus categories where cardholders can earn 5% cash back on purchases, up to a certain spending limit. While this program may seem straightforward, understanding its nuances can be key to maximizing its benefits.

Understanding the 5% Cash Back Calendar Mechanics

The 5% cash back calendar operates on a quarterly basis, meaning the bonus categories change every three months. Here’s a breakdown of the mechanics:

- Quarterly Rotation: Each quarter, Chase announces four new bonus categories, typically covering a diverse range of spending, such as dining, travel, or online shopping.

- Spending Limit: While offering 5% cash back, the program usually imposes a spending limit for each bonus category. This limit, generally $1,500 per quarter, ensures the program remains sustainable for Chase.

- Activation: To earn the 5% cash back, cardholders must activate the bonus categories within the first few days of each quarter. This can be easily done online or through the Chase mobile app.

- Redemption: Earned cash back can be redeemed for various options, including statement credits, gift cards, travel rewards, or deposited into a Chase checking or savings account.

5% Cash Back Calendar: A Detailed Guide

While the specific categories vary each quarter, understanding the typical categories can help you strategize your spending:

1. Dining: This category consistently appears on the calendar, offering 5% cash back at restaurants. This is a popular choice for frequent diners, providing a substantial return on their food expenses.

2. Travel: Travel expenses, including flights, hotels, and car rentals, often feature on the calendar, making it advantageous for those planning vacations or business trips.

3. Online Shopping: With the rise of e-commerce, this category has become increasingly common, offering 5% cash back on purchases made at various online retailers.

4. Department Stores: This category allows for 5% cash back at select department stores, covering a wide range of goods and services.

5. Home Improvement: Home improvement projects can be expensive, and this category provides an opportunity to earn 5% cash back on purchases at hardware stores, home improvement retailers, and online platforms.

Leveraging the 5% Cash Back Calendar for Maximum Rewards

Maximizing your rewards through the 5% cash back calendar requires strategic planning and awareness. Here’s a breakdown of effective strategies:

1. Track the Calendar: Staying informed about the upcoming bonus categories is crucial. Subscribe to email alerts or set reminders to ensure you don’t miss out on activating the categories on time.

2. Plan Your Spending: Analyze your upcoming expenses and align them with the bonus categories. For example, if travel is a bonus category, consider booking flights or hotels during that quarter.

3. Utilize the Spending Limit: Make the most of the spending limit by strategically allocating your purchases within the bonus categories.

4. Combine with Other Rewards: The 5% cash back calendar can be combined with other Chase rewards programs, such as the Ultimate Rewards program, to maximize your overall earnings.

5. Consider a Chase Freedom Unlimited Card: While the Chase Freedom card offers the 5% cash back calendar, the Freedom Unlimited card provides a consistent 1.5% cash back on all purchases, which can be a more suitable option for those who don’t want to track bonus categories.

FAQs: 5% Cash Back Chase Calendar

Q: How often does the 5% cash back calendar update?

A: The calendar updates every quarter, typically at the beginning of January, April, July, and October.

Q: Do I need to activate the bonus categories every quarter?

A: Yes, activation is required for each quarter. Failure to activate will result in earning only the standard cash back rate for your card, typically 1% for the Chase Freedom card.

Q: Can I earn 5% cash back on all purchases?

A: No, the 5% cash back applies only to purchases made within the designated bonus categories.

Q: What happens if I exceed the spending limit for a bonus category?

A: Once you reach the spending limit, you will revert to the standard cash back rate for that category.

Q: Can I redeem my cash back for cash?

A: You can redeem your cash back for a statement credit, which effectively reduces your credit card balance.

Q: How can I track my 5% cash back earnings?

A: You can monitor your earnings through your Chase online account or the Chase mobile app.

Tips for Utilizing the 5% Cash Back Calendar Effectively

1. Set Spending Goals: Determine how much you plan to spend within each bonus category to make the most of the spending limit.

2. Use the Chase Mobile App: The app allows you to easily track your spending, activate bonus categories, and monitor your rewards.

3. Consider a Cash Back Tracking App: Third-party apps can help you track your spending and identify opportunities to maximize your 5% cash back earnings.

4. Be Mindful of Exclusions: Certain purchases within the bonus categories may be excluded from the 5% cash back offer. Carefully review the terms and conditions for each category.

5. Plan for Upcoming Expenses: If you anticipate large purchases within a particular bonus category, adjust your spending accordingly to maximize your rewards.

Conclusion: The 5% Cash Back Chase Calendar – A Valuable Tool for Rewards

The 5% cash back calendar, while requiring some effort and planning, offers a valuable opportunity to earn significant rewards on your everyday purchases. By understanding the program mechanics, tracking the calendar updates, and strategically planning your spending, you can effectively leverage this program to maximize your cash back earnings and reap the benefits of your Chase card. Remember, maximizing your rewards requires awareness, planning, and a little bit of effort, but the potential returns make it a worthwhile endeavor.

Closure

Thus, we hope this article has provided valuable insights into Navigating the 5% Cash Back Chase Calendar: A Guide to Maximizing Your Rewards. We appreciate your attention to our article. See you in our next article!